When your pharmacy tells you your generic medication isn’t covered, it’s not just a hassle-it’s a health risk. You’ve been taking the same pill for years. It works. It’s cheap. But now, your insurance says it’s non-formulary. That means it’s not on their approved list. You’re stuck. You can’t get it. And if you don’t, your condition could get worse. This isn’t rare. In 2022, over 12% of all generic prescriptions were denied because they weren’t on the plan’s formulary. For people with autoimmune diseases, that number jumped to nearly 25%. The system isn’t broken-it’s designed this way. But you have rights. And there’s a clear path forward.

What exactly is a non-formulary generic?

A formulary is the list of drugs your insurance plan agrees to cover. It’s not a list of every drug ever made. It’s a curated list, chosen by the plan based on cost, effectiveness, and sometimes, deals with drug companies. Generic drugs are usually cheaper versions of brand-name drugs. They’re just as safe and effective. But not all generics make it onto every plan’s formulary. Why? Sometimes, the plan only covers one generic version of a drug, even if others exist. Or they’ve cut a deal with a specific manufacturer. Or they just didn’t include it when they updated their list last year.

So if your doctor prescribes a generic that’s not on the list, your plan will deny coverage. That doesn’t mean the drug is bad. It just means your insurer doesn’t have a contract for it. And that’s where things get messy.

Why does this happen-and why should you care?

Insurance companies use formularies to control costs. They want you to take the cheapest option they’ve negotiated. But sometimes, the cheapest option doesn’t work for you. Maybe you tried it before and it gave you stomach cramps. Maybe it doesn’t absorb right in your body. Maybe your condition is so specific that only one version of the drug keeps you stable. For someone with Crohn’s disease, switching from one generic mesalamine to another can trigger a flare. For someone with epilepsy, a different filler in the pill could cause seizures.

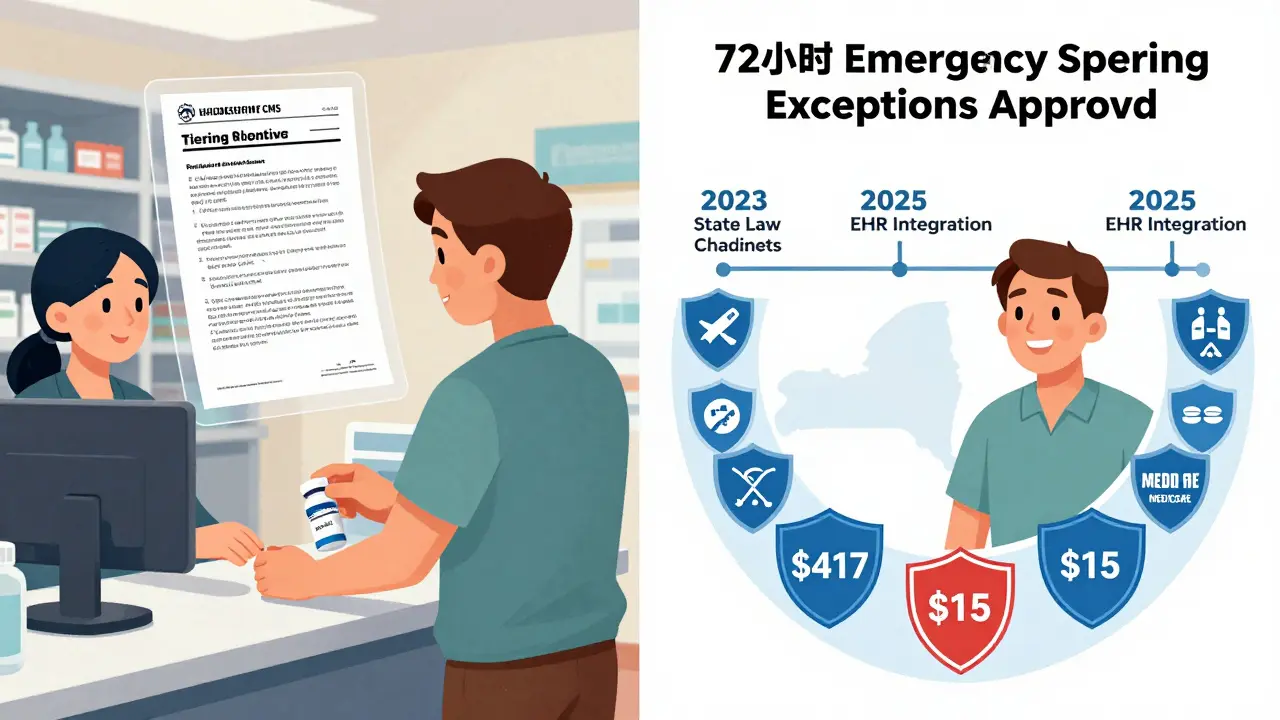

When coverage is denied, you’re left with two bad choices: pay full price-or go without. The average monthly cost difference between a formulary generic and a non-formulary one? $287. That’s not a typo. For a 90-day supply of metformin, one patient paid $417 out-of-pocket when it was denied, even though the same drug usually costs $15. That’s why 38% of people skip doses or cut their pills in half when they can’t get their medication.

What’s your legal right? The exceptions process

Federal law says you can’t be denied access to a drug you need just because it’s not on the list. There’s a formal process called a coverage exception request. It’s your legal right to ask for coverage even if the drug isn’t on the formulary. This isn’t a loophole. It’s a requirement.

Here’s how it works:

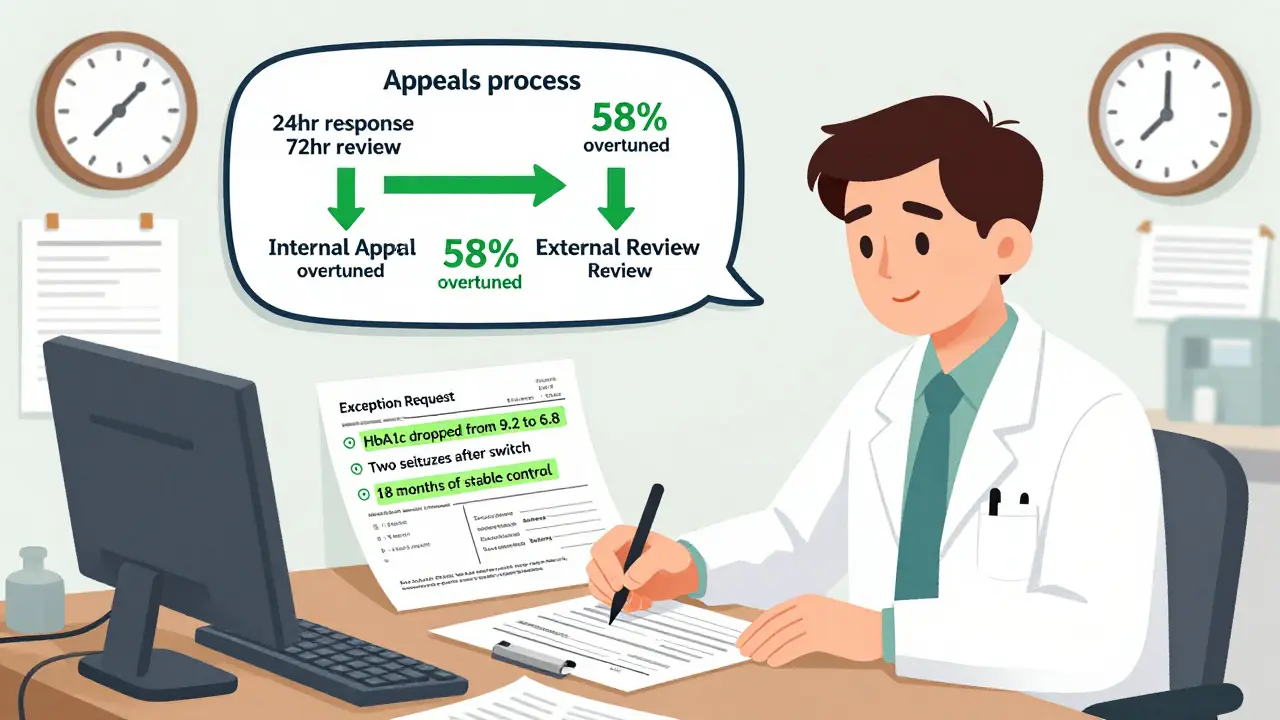

- You or your pharmacy request a coverage determination. The plan must respond within 24 hours.

- If denied, your doctor files a formal exception request. This isn’t just a form. It needs clinical details: why other drugs won’t work, what side effects you’ve had, what lab results prove you need this specific medication.

- The plan has 72 business hours to respond. For urgent cases (like if you’re in the hospital or your condition is worsening), they have 24 hours.

- If they say no again, you can appeal internally. You have 60 days to file.

- If the internal appeal fails, you can request an independent external review. This is a third-party doctor who reviews your case. They can overturn the decision.

And here’s the kicker: 58% of initial denials are overturned when appealed. That’s more than half. If you push back, you have a real shot.

What your doctor needs to write

Most denials happen because the request is too vague. Saying “this drug works better for my patient” isn’t enough. The plan needs specifics. Here’s what your doctor should include:

- Exact reasons why formulary alternatives failed: “Patient developed severe nausea with generic A, rash with generic B.”

- History of prior treatments: “Tried three different generics over 18 months. Only this one maintained stable disease control.”

- Clinical data: “HbA1c dropped from 9.2 to 6.8 on this formulation. Switching caused rebound to 8.1.”

- Documented adverse effects: “Patient experienced two seizures after switching to a different generic anticonvulsant.”

Doctors spend over 13 hours a week just handling these requests. But if the form is filled out right, approval rates jump to 74%. The Crohn’s & Colitis Foundation has a template that works. Ask your doctor to use it.

What about cost? Can you get a lower copay?

Even if your exception is approved, your plan might still make you pay a lot. That’s because federal rules say: if a drug is non-formulary, you can’t get it moved to a lower cost tier-even if it’s now covered. So you might still pay 3.7 times more than if it were on the formulary. That’s a trap.

But here’s something many don’t know: you can request a tiering exception separately. If the drug is approved for coverage, you can ask: “Can this be placed in Tier 2 instead of Tier 4?” You have to file this as a second request. It’s not automatic. And most doctors don’t know to do it. But if you do, you can cut your out-of-pocket costs dramatically.

What if you need it right now?

If you’re out of medication and your exception is pending, federal law says the plan must give you a 72-hour emergency supply. That’s right-72 hours of the drug, free or at a reduced cost, while they review your case. But here’s the problem: 37% of plans ignore this rule. They say “no emergency supply” even though the law says they must provide it.

Call your insurer. Ask: “What’s my right to an emergency supply under CMS guidelines?” If they say no, ask for the name of the person you’re speaking with, and say you’ll file a formal complaint. Most plans will cave when they know you know your rights.

Who’s most affected?

Not all conditions are treated the same. Medicare and private plans have higher approval rates for certain drugs. Anticonvulsants? 95% approval rate. Insulin? Automatically approved under the 2024 Medicare redesign. Naloxone? Covered without exception.

But gastrointestinal drugs? Only 52% approval rate. Why? Because insurers think “all mesalamines are the same.” They’re wrong. Patients with IBD know better. So do their doctors. The same goes for psychiatric medications and hormone therapies.

And here’s a hidden trend: more plans are using “specialty pharmacy carve-outs” for generics. That means even if a drug is covered, you have to get it from a specific pharmacy you didn’t choose. And those pharmacies often charge more. It’s a new way to restrict access without technically denying coverage.

Real stories: How people beat the system

One patient on Reddit, ‘PharmTechSarah,’ spent months appealing a denial for generic mesalamine. She submitted four times. Each time, she added more lab results, doctor notes, and a timeline of her flares. On the fifth try, they approved it. She now keeps a folder of every test result, every prescription, every denial letter. “It’s not just about the drug,” she says. “It’s about proving you’re not just another claim.”

Another patient, ‘DiabetesWarrior,’ paid $417 out-of-pocket for 90 days of metformin. Then she submitted her A1c logs showing her numbers dropped and stayed low only on this specific formulation. The appeal took 11 days. She got approved. Her next 90-day supply cost $15.

The pattern? Documentation. Persistence. Knowing the rules.

What’s changing in 2025?

By 2025, CMS plans to integrate the exception process directly into electronic health records. That means your doctor’s notes could auto-fill the request. No more paper forms. No more delays. The goal? Cut processing time by 40%.

Also, 17 states passed laws in 2023 to tighten the rules. New York is pushing for 24-hour reviews on all non-urgent cases. California already has it. More states are following.

But the biggest change? The 2024 Medicare redesign automatically covers insulin, naloxone, and a few other high-need generics without exceptions. That’s a win. And it’s a sign that pressure from patients is working.

What to do right now

If your generic was denied:

- Don’t stop taking your medication. Ask your doctor for a short-term supply or contact your pharmacy-they may have samples.

- Call your insurer. Ask for the coverage determination form. Get it in writing.

- Ask your doctor to file a formal exception request using clinical details-not just “it works better.”

- Request an emergency 72-hour supply if you’re running out.

- File an internal appeal if denied. You have 60 days.

- Request an external review if the appeal fails.

- Separately, file a tiering exception request to lower your cost.

You don’t need a lawyer. You don’t need to be rich. You just need to know the rules and refuse to accept “no” as the final answer.

What if my doctor won’t help me file an exception?

Many doctors are overwhelmed. But if your doctor refuses, ask to speak with their office manager or a patient advocate. Most clinics have someone who handles prior authorizations. If not, contact your insurer’s patient services line-they can send your doctor a pre-filled form. You can also use templates from patient advocacy groups like the Crohn’s & Colitis Foundation or the American Medical Association. Your doctor’s license requires them to provide necessary care-not to avoid paperwork.

Can I switch to a different insurance plan to avoid this?

Only during open enrollment, unless you qualify for a special enrollment period (like losing other coverage or moving). Medicare Part D plans change their formularies every year. Before enrolling, check the plan’s formulary online. Look up your exact generic drug by name and manufacturer. If it’s not listed, don’t enroll. Don’t assume “it’s a generic, so it’s covered.” It’s not.

Are brand-name drugs easier to get covered than generics?

Sometimes. If your generic is denied, your insurer might approve the brand-name version-but at a much higher cost. That’s why you should always request the generic first. If they deny it, you can then ask for the brand-name as an alternative. But you’ll pay more. The exception process is designed to get you the generic you need, not to push you toward expensive brands.

How long does the entire appeal process take?

From denial to final decision, it usually takes 14 to 21 days. The first response comes in 72 hours. The internal appeal takes 30 days. The external review adds another 7 to 14 days. If you’re in urgent need, you can request an expedited review-this cuts the timeline to under 7 days. Always ask for it if your condition is worsening.

Can I get help from patient assistance programs?

Yes. Many drug manufacturers offer free or low-cost medication through patient assistance programs-even for generics. If your insurance denies coverage, contact the manufacturer directly. Companies like Teva, Mylan, and Apotex have programs to help people who can’t afford their drugs. You don’t need to be poor. You just need to show you’re being denied coverage. Some programs will even cover the cost while your appeal is pending.

Ashlyn Ellison

February 11, 2026 AT 08:04Marie Fontaine

February 12, 2026 AT 07:28Tatiana Barbosa

February 12, 2026 AT 19:38MANI V

February 14, 2026 AT 05:35Susan Kwan

February 14, 2026 AT 07:39Sam Dickison

February 15, 2026 AT 10:23Joseph Charles Colin

February 16, 2026 AT 19:00John Sonnenberg

February 17, 2026 AT 18:07Joshua Smith

February 19, 2026 AT 09:02Jessica Klaar

February 19, 2026 AT 21:09PAUL MCQUEEN

February 20, 2026 AT 01:36glenn mendoza

February 20, 2026 AT 11:30Kathryn Lenn

February 21, 2026 AT 15:56