Many people assume that if they have long-term care insurance, it will pay for everything when they move into a nursing home - including their daily medications. That’s not true. And the confusion around this can lead to serious financial surprises, missed doses, or even hospitalizations. The truth is, long-term care insurance doesn’t cover prescription drugs, generic or brand-name. Not even close.

What Long-Term Care Insurance Actually Covers

Long-term care insurance is designed for one thing: paying for help with daily living. That means bathing, dressing, eating, moving from bed to chair, and other non-medical tasks that become hard with age or illness. It covers room and board in a nursing home, assisted living, or in-home care. But it draws a hard line at medical treatment. That includes doctor visits, physical therapy, and yes - prescription drugs. This isn’t a loophole. It’s by design. When these policies were created in the 1970s, lawmakers and insurers wanted to avoid overlap with Medicare and Medicaid. They knew medical care, including drugs, was already being handled elsewhere. So long-term care insurance was built to fill the gap for custodial care - the kind that doesn’t require a licensed nurse, but still needs someone to be there every day.Who Pays for Generic Drugs in Nursing Homes?

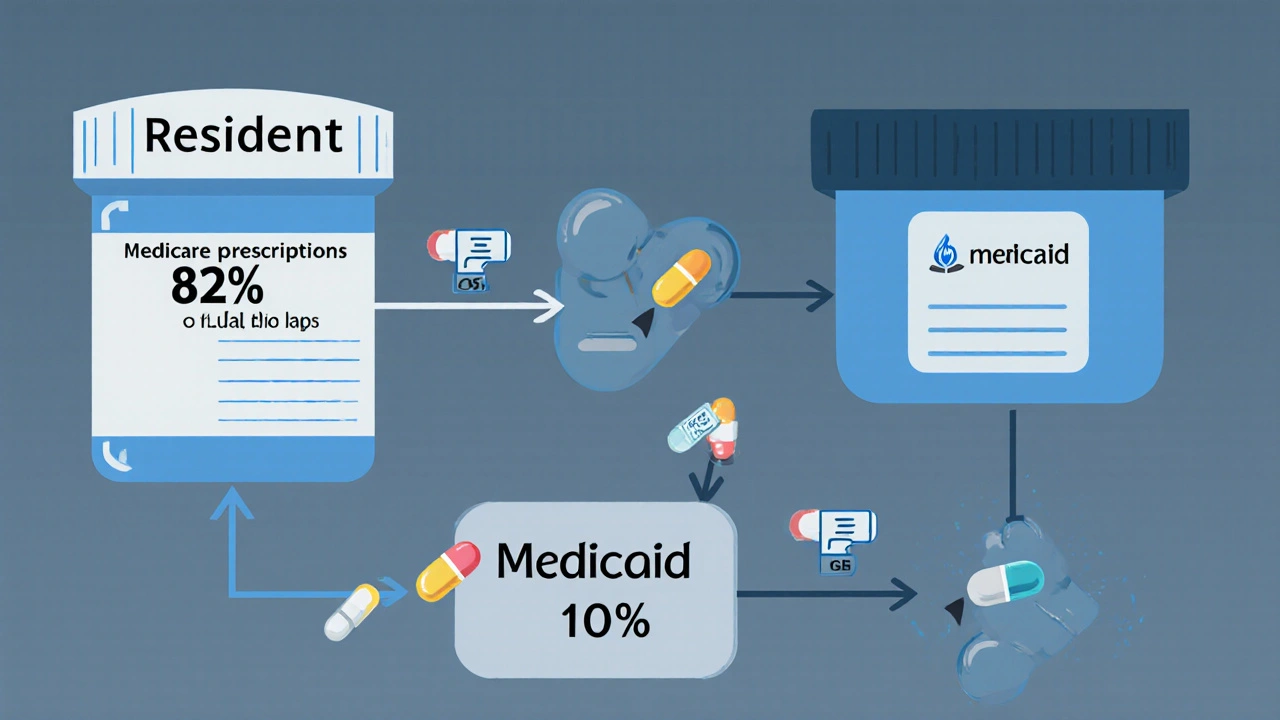

If long-term care insurance won’t pay for your pills, then who does? For most nursing home residents, the answer is Medicare Part D. Since its launch in 2006, Part D has become the main source of drug coverage in nursing homes. A 2020 study found it covers 82.4% of all prescriptions for Medicare enrollees living in these facilities. That’s more than four out of five residents. Part D plans cover both brand-name and generic drugs. But here’s the key: they pay less for generics. Most plans charge a $5 or $10 copay for a 30-day supply of a generic medication - compared to $30 or more for the brand version. That’s why nursing homes rely heavily on generics. In fact, about 90% of all prescriptions written in nursing homes are for generic drugs. They’re cheaper, just as effective, and preferred by most Part D plans. For residents who are also on Medicaid (called “dual eligibles”), drug coverage comes through Part D too. Even though Medicaid used to pay for drugs directly, the system changed after 2006. Now, Medicare Part D is the primary payer. Medicaid only steps in to cover costs Part D doesn’t - like the monthly premium or cost-sharing if the resident qualifies for extra help.What About Private Long-Term Care Insurance?

Some people buy private long-term care insurance policies through companies like Genworth or John Hancock. These policies can be expensive - often costing $2,000 to $4,000 a year - but they offer more flexibility than Medicaid. Still, not one of them covers prescription drugs. Even if your policy says it pays for “all care needs,” the fine print always excludes medications. That’s because insurers know drugs are covered under other programs. They don’t want to duplicate coverage. If you’re relying on private long-term care insurance and think your pills are included, you’re at risk. One woman in Ohio paid $3,000 a year for her policy for 12 years. When she moved into a nursing home, she assumed her insulin, blood pressure meds, and cholesterol pills were covered. They weren’t. She ended up paying $1,200 out of pocket in one year - money she didn’t have.

Formularies and the Hidden Barriers to Generic Drugs

Just because Part D covers generics doesn’t mean every resident gets them easily. Each Part D plan has a list of approved drugs called a formulary. If your medication isn’t on that list, you might have to wait weeks to get it - or pay full price. Nursing homes have to check each new resident’s Part D plan to see what drugs are covered. They also need to know if their own pharmacy works with that plan. If not, they have to switch pharmacies - a process that can take days or even weeks. During that time, the resident might go without meds. Some plans make it worse. They limit how many generics they’ll cover per month. Or they require prior authorization for common drugs like gabapentin or metformin. One 2022 study found that nearly 1 in 5 nursing home residents had a prescription delayed because their drug wasn’t on the plan’s formulary. And even when they request an exception, plans often deny it - especially if the drug is cheaper than the one they prefer.The 10% Who Get Left Behind

About 8.9% of nursing home residents - roughly 115,000 people - have no drug coverage at all. They’re either not enrolled in Part D, or they’re dual eligibles who missed the enrollment window. Some can’t afford the premium. Others don’t understand how to sign up. A few are in denial about needing help. These residents pay out of pocket. Or they get temporary help from charity programs. Or they skip doses. A 2020 study showed that residents without drug coverage received 40% fewer prescriptions than those with Part D. That’s not just inconvenient - it’s dangerous. Missing blood pressure or diabetes meds can lead to falls, strokes, or emergency room visits.

What’s Changing in 2025?

Good news: things are getting better. The Inflation Reduction Act of 2022 brought major changes. Starting in 2025, Medicare Part D beneficiaries will never pay more than $2,000 a year for drugs - no matter how many they take. That’s huge for nursing home residents on multiple medications. Also starting in 2025, Part D plans must cover all drugs on the official Medicare formulary. No more “limited formularies” that leave out common generics. And plans must respond to exceptions requests within 72 hours for nursing home residents. That’s a big improvement from the 5-7 days some plans used to take. These changes won’t fix everything. But they’ll cut down on delays and out-of-pocket costs. They’ll also make it easier for nursing homes to manage drug coverage - which currently takes staff an average of 10-15 hours per week per facility.What You Should Do Now

If you or a loved one is entering a nursing home, here’s what to do:- Confirm whether you’re enrolled in Medicare Part D. If not, sign up immediately. You can’t wait until you’re in the facility.

- Ask the nursing home’s pharmacy team which Part D plans they work with. Make sure your plan is on the list.

- Get a copy of your plan’s formulary. Check that your current medications - especially generics - are covered.

- If a drug isn’t covered, ask for an exception. You have the right to appeal.

- Don’t assume long-term care insurance covers your pills. It doesn’t. Plan for drug costs separately.

Bottom Line

Long-term care insurance is a valuable tool - but it’s not a magic wand. It won’t pay for your medications. Medicare Part D will. And while Part D isn’t perfect, it’s the best system we have. The real challenge isn’t the cost of drugs - it’s navigating the system. The paperwork. The delays. The formularies that change every year. The good news? You’re not alone. Nursing homes, pharmacists, and advocates are working to fix the gaps. And with new rules coming in 2025, the system is slowly becoming more reliable. But until then, the responsibility falls on you - or your family - to make sure your meds don’t get lost in the bureaucracy.Does long-term care insurance cover generic drugs in nursing homes?

No, long-term care insurance does not cover any prescription drugs, including generics. It only pays for custodial care like help with bathing, dressing, and eating. Drug coverage comes from Medicare Part D, Medicaid, or private health insurance.

Who pays for medications in a nursing home?

Medicare Part D pays for about 82% of prescriptions in nursing homes. Medicaid covers most of the rest for low-income residents. A small number pay out of pocket or get help from charity programs. Long-term care insurance never covers drugs.

Why do nursing homes use so many generic drugs?

Generics are just as safe and effective as brand-name drugs, but cost 80-90% less. Medicare Part D plans encourage their use by charging lower copays. Over 90% of prescriptions in nursing homes are for generics because they’re affordable and widely covered.

What if my medication isn’t on the Part D formulary?

You can request an exception. The nursing home or your doctor can submit paperwork to your Part D plan. By law, plans must respond within 72 hours for nursing home residents. If denied, you can appeal. Some plans also offer temporary coverage for up to 180 days while the appeal is processed.

Can I switch Part D plans after moving into a nursing home?

Yes, but only during specific enrollment periods. The Annual Enrollment Period (October 15-December 7) and the Medicare Advantage Disenrollment Period (January 1-February 14) are the main times you can switch. Special enrollment periods may apply if you move into a nursing home and your current plan doesn’t work with the facility’s pharmacy.

What happens if I don’t enroll in Medicare Part D?

You’ll pay full price for all prescriptions - which can cost hundreds or even thousands of dollars a month. You may also face a late enrollment penalty if you sign up later. About 10% of nursing home residents have no drug coverage and struggle to afford their meds.

Will the $2,000 cap on drug costs in 2025 help nursing home residents?

Yes. Currently, some residents pay thousands out of pocket each year, especially if they take multiple high-cost drugs. The $2,000 annual cap - starting in 2025 - will protect them from catastrophic drug costs. It’s one of the biggest improvements to Part D in years.

Alex Dubrovin

November 23, 2025 AT 19:35Just found out my grandma's policy doesn't cover her blood pressure meds and now I'm scrambling to figure out Part D

Why the hell is this not common knowledge? I paid for that insurance thinking it covered everything

Jacob McConaghy

November 24, 2025 AT 03:39Man this is exactly why we need better public education on this stuff

People think long-term care insurance is like health insurance but it's really just custodial care coverage

My uncle in Florida got hit with $1,800 in meds last year because he assumed his policy covered prescriptions

Turns out he was paying $3,500/year for nothing but bath help

Biggest financial trap for seniors I've ever seen

Natashia Luu

November 24, 2025 AT 20:32It is absolutely unacceptable that the elderly are being left to navigate this bureaucratic nightmare alone. The lack of transparency in insurance policies is criminal. One must wonder how many lives have been lost due to medication non-adherence because of this systemic failure. This is not just inconvenient-it is morally indefensible.

akhilesh jha

November 26, 2025 AT 08:29Interesting. In India, nursing homes are rare and most elderly are cared for by family. But when they do go to hospitals, medicines are usually paid out of pocket or through government schemes. I never realized how complex the US system is. The formulary delays sound like a nightmare. How do people survive this?

Jeff Hicken

November 27, 2025 AT 00:55so like... long term care ins doesnt cover pills?? wow i had no idea

my aunt paid 5k a year for years and now shes in a home and her insulin costs 400 a month??

lmao what a scam

Vineeta Puri

November 27, 2025 AT 09:25It is imperative that families and caregivers proactively engage with Medicare Part D enrollment prior to admission to a nursing facility. The consequences of non-enrollment are severe and entirely preventable. One must consult with a certified Medicare counselor to ensure that all formularies are reviewed and that exceptions are filed in a timely manner. The burden should not fall solely on the resident.

Victoria Stanley

November 28, 2025 AT 04:29Just helped my neighbor enroll in Part D after she missed the window and got hit with a penalty

She was crying because she thought her long-term care policy covered her diabetes meds

Turns out she was paying $2,700/year for nothing

But now she’s on a plan that covers metformin for $5

So if you’re reading this and you’re not sure - call your local Area Agency on Aging. They’ll walk you through it for free. Seriously. Do it.

Andy Louis-Charles

November 28, 2025 AT 16:042025’s $2k cap is a game changer 🙌

My mom’s on 7 meds and was hitting $3,200/year

Now she’ll pay max $2k - and that’s with the new rule forcing plans to cover all generics

Also, 72-hour response time? YES. Finally some urgency for nursing home patients

Big win for seniors

Douglas cardoza

November 28, 2025 AT 18:04wait so my insurance was a waste of money??