Why generic drugs aren’t just cheaper-they’re smarter

You’ve probably seen the label: generic. Same active ingredient. Same FDA approval. Half the price-or less. But here’s the thing most people miss: the real savings aren’t just in your co-pay. They’re in the system. And the only way we know how much? Through cost-effectiveness analysis.

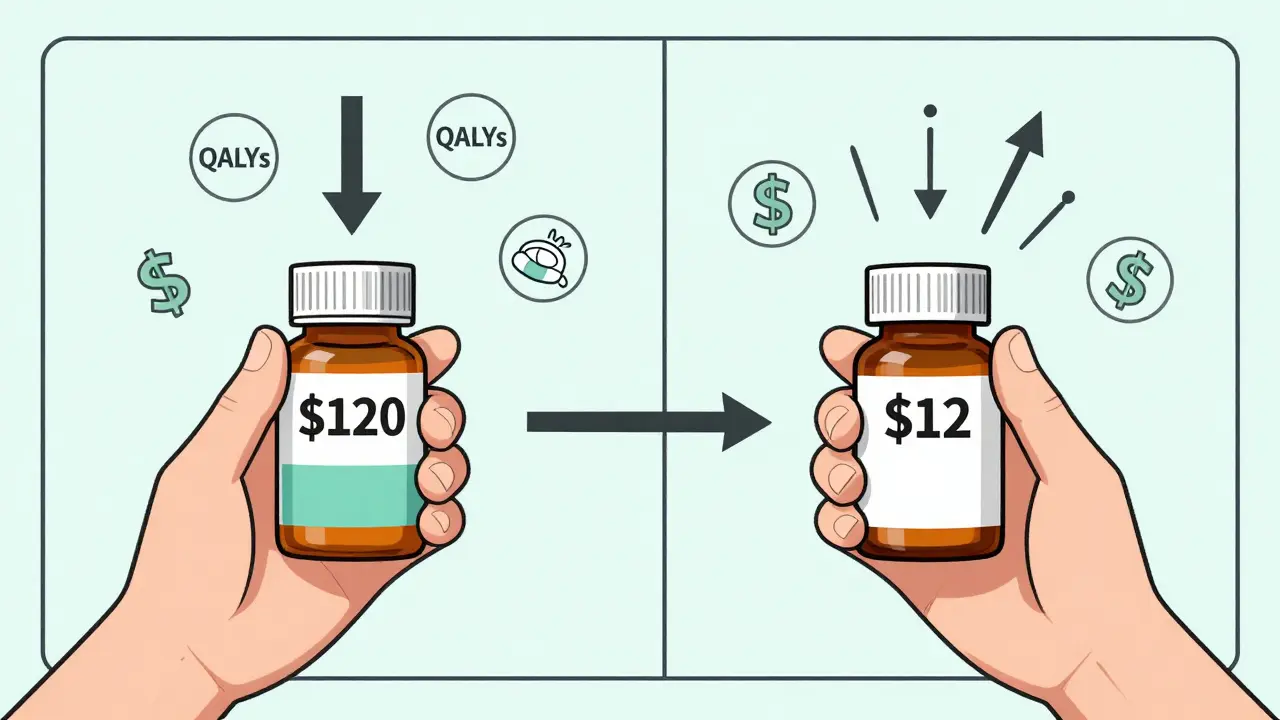

Let’s say you’re on a brand-name blood pressure pill that costs $120 a month. Your doctor switches you to the generic. Now it’s $12. That’s an 90% drop. Sounds great, right? But what if the generic you got is still $80-because it’s one of the high-cost generics that shouldn’t even be on the formulary? That’s not savings. That’s a missed opportunity. And that’s where cost-effectiveness analysis steps in.

What cost-effectiveness analysis actually measures

Cost-effectiveness analysis (CEA) doesn’t just compare prices. It asks: What health outcome do we get for every dollar spent? The standard unit? Quality-adjusted life years, or QALYs. One QALY equals one year of perfect health. If Drug A adds 0.5 QALYs at a cost of $10,000, its cost-effectiveness ratio is $20,000 per QALY. Drug B adds the same 0.5 QALYs but costs $2,000? That’s $4,000 per QALY. Clear winner.

For generics, this isn’t theoretical. A 2022 study in JAMA Network Open looked at the top 1,000 generic drugs covered by major U.S. insurers. They found 45 generics that cost 15.6 times more than other drugs in the same therapeutic class-drugs that worked just as well. Replacing those 45 with cheaper alternatives would’ve cut spending from $7.5 million down to $873,711. That’s not a rounding error. That’s $6.6 million saved in one snapshot.

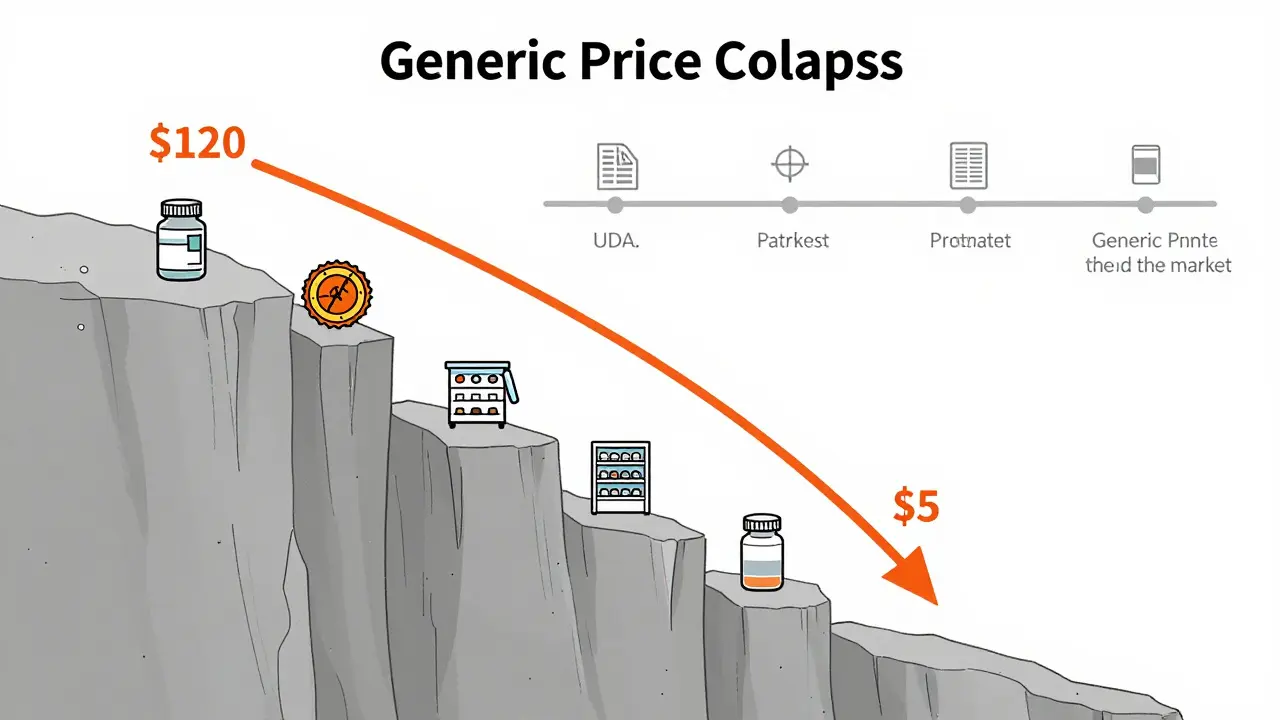

How generic prices crash-and why timing matters

When a brand-name drug’s patent expires, prices don’t slowly decline. They collapse. The FDA found that the first generic competitor triggers a 39% price drop. With six or more generics on the market? Prices fall over 95% below the original brand price.

But here’s the catch: most cost-effectiveness studies ignore this. A 2021 ISPOR conference review found that 94% of published CEAs don’t account for future generic entry. That’s like deciding whether to buy a car based on today’s price, but not considering that next month, three new models will hit the market at half the cost. You’d make the wrong choice.

CEA needs to be dynamic. If you’re evaluating a drug that’s due to go generic in 18 months, your analysis must factor in that coming price drop. Otherwise, you risk rejecting a truly cost-effective option just because it’s still branded today. The VA Health Economics Resource Center warns: failing to model patent expiration biases analysis against pharmaceuticals-exactly when we should be encouraging their use.

Therapeutic substitution: the hidden savings engine

Not all savings come from swapping a brand for its generic. Sometimes, the best deal isn’t even the same drug.

Take statins. You might be on atorvastatin (Lipitor’s generic). But simvastatin, a different statin, works just as well for most people-and costs 20 times less. The JAMA study found that when generics were swapped for other drugs in the same class, prices were 20.6 times higher than the cheapest alternative. That’s not a pricing glitch. That’s a systemic failure.

Even within the same drug, dosage form matters. A 10mg tablet might cost $15, while the same drug in a 20mg tablet costs $25-despite being chemically identical. Splitting the higher dose? Often cheaper. But most formularies don’t allow that. Why? Because Pharmacy Benefit Managers (PBMs) profit from the spread between what they pay pharmacies and what insurers reimburse. Higher-priced generics mean bigger spreads. And that’s why the cheapest option isn’t always the one you get.

Who’s doing it right-and who’s falling behind

In Europe, over 90% of health technology assessment agencies use formal cost-effectiveness analysis to decide which drugs to cover. In the U.S.? Only 35% of commercial payers do. That’s not because U.S. systems are smarter. It’s because they’re fragmented.

Organizations like ICER publish detailed, transparent reports. But many insurers keep their methods secret. And industry-funded studies? They’re more likely to report favorable results. A 2000 Health Affairs review found that studies paid for by drug makers were significantly more likely to say their drug was cost-effective.

There’s a better way. The NIH’s 2023 framework lays out three rules: design proportionate processes, compare multiple treatment options, and update decision rules as generics enter the market. Simple. Practical. And it’s already working in VA hospitals and Medicare Advantage plans that use real-time pricing data.

The .7 trillion question

Over the last decade, generic drugs saved the U.S. healthcare system $1.7 trillion. That’s more than the entire annual budget of the Department of Defense. And yet, we still pay too much for generics that shouldn’t cost so much.

Generics make up 90% of all prescriptions filled-but only 17% of total drug spending. That’s the power of competition. But if we keep using high-cost generics because of opaque pricing, PBMs, and outdated formularies, we’re throwing away billions.

The 2022 Inflation Reduction Act and 2020 Drug Pricing Reduction Act are pushing Medicare Part D to prioritize cost-effective options. But change won’t come from legislation alone. It comes from better analysis. Better data. And better decisions.

What you can do

If you’re a patient: Ask your pharmacist if there’s a cheaper alternative-even if it’s not the exact same drug. Ask if splitting a higher-dose pill is safe and cheaper. Don’t assume your prescription is the lowest-cost option.

If you’re a provider: Push for therapeutic substitution. Don’t default to the first generic. Check if another drug in the same class offers the same benefit at a fraction of the cost.

If you’re a payer or administrator: Build dynamic CEA models that factor in patent cliffs. Require transparency from PBMs. Reward formularies that prioritize true cost-effectiveness-not just brand loyalty or profit margins.

Cost-effectiveness analysis isn’t about cutting corners. It’s about cutting waste. And in healthcare, waste isn’t just dollars. It’s missed care, delayed treatments, and lives shortened because we didn’t choose the best value.

Future-proofing drug decisions

Over 300 small-molecule drugs will lose patent protection between 2020 and 2025. That’s a wave of generics coming. The ones who win? Those who plan ahead.

CEA must evolve. It can’t just compare today’s prices. It has to predict tomorrow’s. It has to account for how many competitors will enter. How fast prices will drop. And which alternatives are just as effective.

The goal isn’t just to save money. It’s to save lives-by making sure the right drug, at the right price, reaches the right person. And that starts with asking the right question: not how much does it cost? but how much value does it deliver?

Ansley Mayson

February 3, 2026 AT 08:11Hannah Gliane

February 3, 2026 AT 14:25Murarikar Satishwar

February 4, 2026 AT 18:26Brett MacDonald

February 5, 2026 AT 18:09Sandeep Kumar

February 6, 2026 AT 07:51Gary Mitts

February 7, 2026 AT 12:21Bridget Molokomme

February 8, 2026 AT 01:34jay patel

February 9, 2026 AT 22:36phara don

February 10, 2026 AT 14:55